The Accounts Payable departments spend part of their time processing vendor invoices: collect the invoices from the post mail or email, create the invoices in the system, start the approval process and post the invoices for future payment.

In the era of the artificial intelligence and machine learning, this process can be simplify and done faster by using Optical character recognition (OCR) systems. In Dynamics 365 Finance there is a fantastic OCR that can be used: Invoice Capture.

Let's review the requirements to use it once the App is installed in our Power Platform environment.

Required configuration

Setup System

-

Configuration groups: include the settings for invoice processing, supported invoice types (purchase order invoice, cost invoice or/and header only), and invoice fields to be displayed at the header and lines:

-

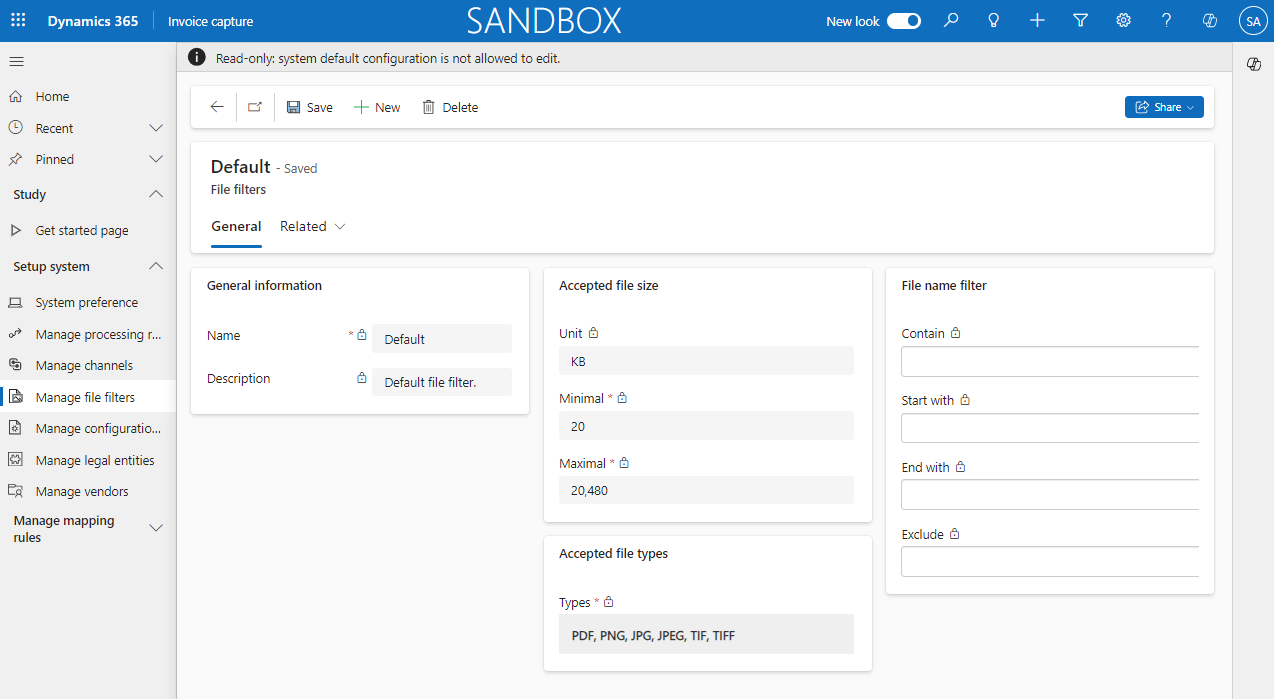

Filters: this is an optional setup and can be set up to exclude unnecessary documents based on file size, type, and name, to reduce the processing time of received invoices.

-

Channels: define the way to receive the invoice files through connections such as Outlook, SharePoint, OneDrive..., by using a flow. In the channel you need to select the related LE, the assigned file filter and define the flow settings.

-

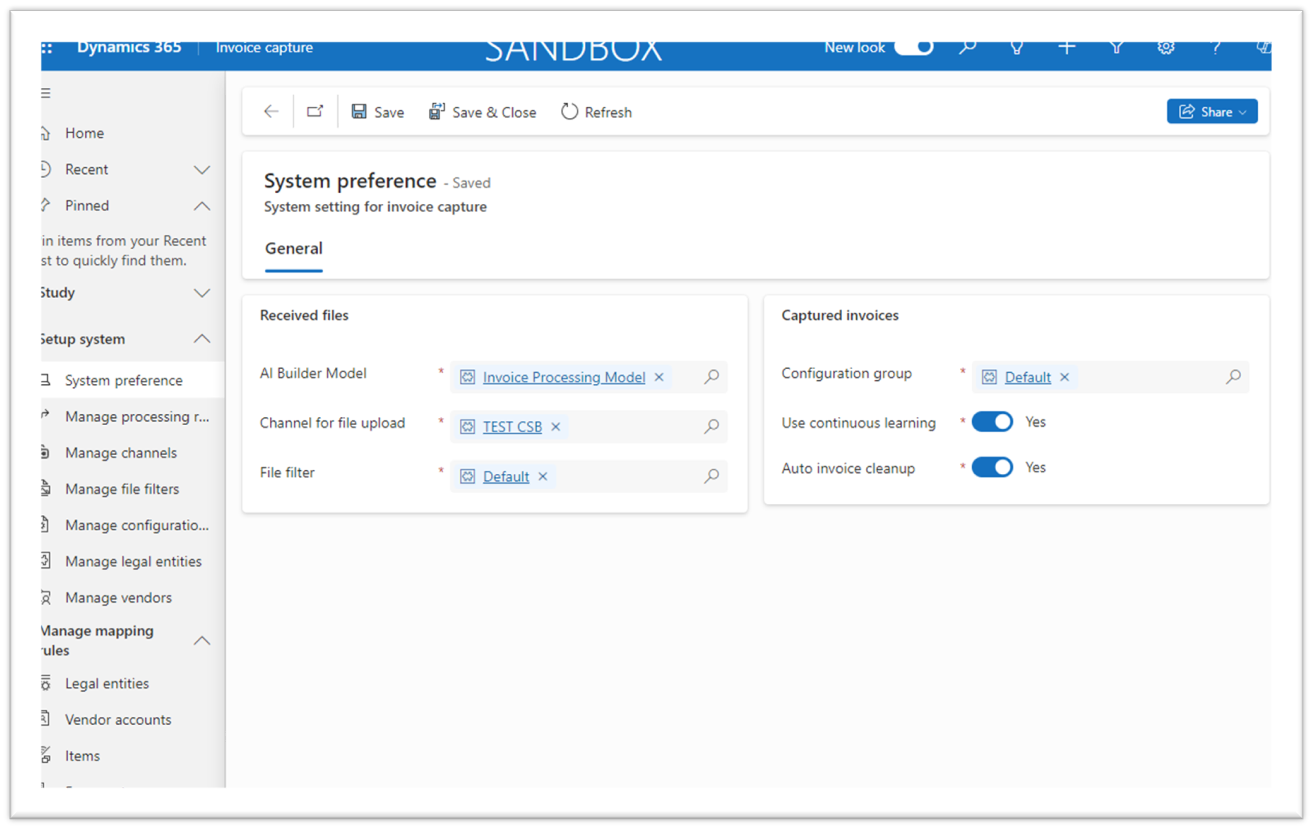

System preference: in this form you will setup the default configurations, channel, file filter, configuration group...

-

Processing rules: derivation rules are applied to ensure that the invoices are complete and correct. Because some rules aren't applicable to all customers, the processing uses parameters to enable or disable the logic; format PO, validate total amounts...

Master data

-

Legal entities: the first step is to enable the legal entities in the Account Payable module and define the integration parameters.

These entities are synchronized in the Invoice Capture app. Once are visible complete the setup selecting the correct "Configuration group" previously defined if a specific format is required by LE; if not the default selected at the "System preference" will be used.

-

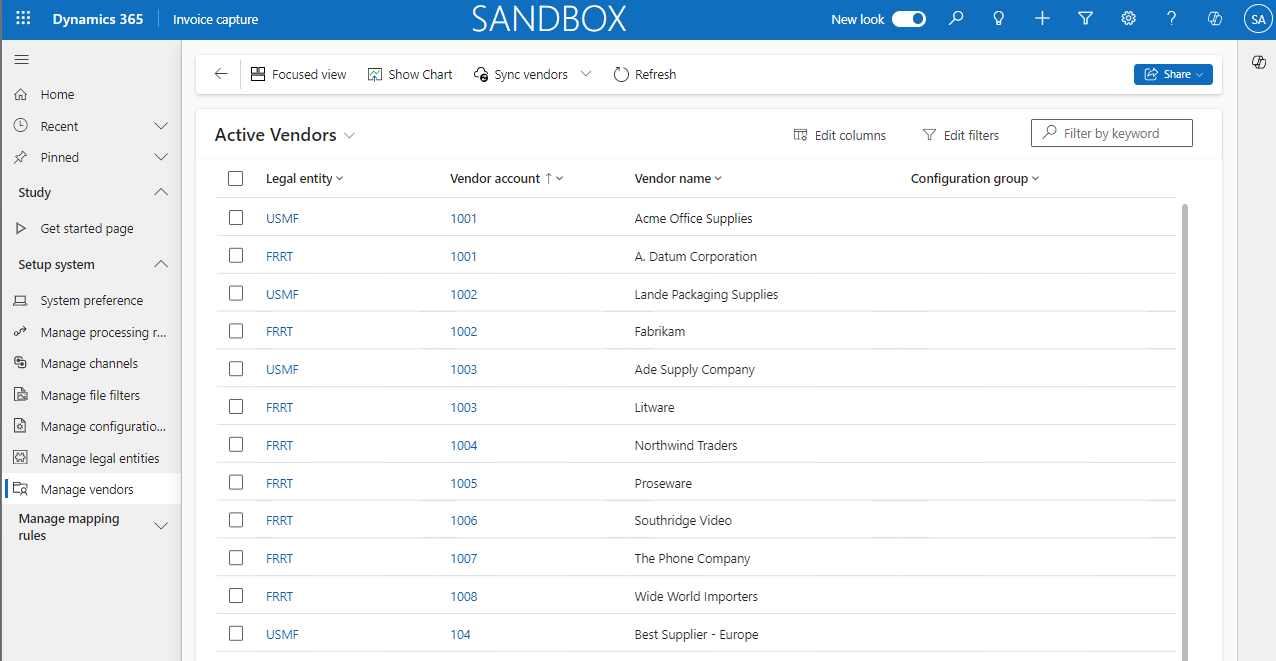

Vendors: for the LE's defined in the ERP with the checkbox "Sync all vendors", these will be visible at the app. It's also possible to define a "Configuration group" if a specific format is required by vendor; if not the default for the LE or system will be used.

Mapping rules

The definition of mapping rules help to easily derive entities such as legal entities, vendors, and items, to increase the touchless rate for invoice processing.

-

Legal entities

-

Vendors

-

Items or expense types

Invoice capture process

Based on the channel configuration the invoices should be upload manually in the "Received files" form or it will be automatically imported by using the defined flow. Once the invoice are imported, it can be visible from the "Captured invoices" form:

In this screen it's possible to complete the review of the invoice files and verify that the information obtained from the file by the app using the artificial intelligent and the machine learning are correct or not, including the invoice classification (PO invoice, cost invoice or header only) and the defined files by header and lines:

Once the invoice is reviewed it will be transfer to Dynamics 365 Finance to continue the defined business process.

To follow the files status is recommend to use the Invoice capture dashboard, that includes charts that provide an overview of invoices that have been imported and can help to analyze the performance of the invoice generation process.

This app can improve the daily of the AP teams because they will save time and effort in tasks that can be easily automatize. Don't hesitate to start to use the Invoice Capture and write us to share your comments and feedback!