One of the powerful tools in Microsoft Dynamics 365 Finance is the use of multiple currencies with the specific exchange rates for the posting of vendor invoices, bank transfers, payments... as a summary, all the required movements that need to be posted in a company.

After all the transactions are posted at the end of the month is required to run the periodic process for Foreign currency revaluation to calculate and post the currency revaluation adjustments from the exchange rate used the date the transaction is posted to the end of the month exchange rate.

In the system this process to calculate the fluctuations in exchange rates is separate in four modules. Let's see an overview about what can be done.

Foreign currency revaluation for accounts payable and accounts receivable.

Both processes uses a new exchange rate to revalue the open amounts (not settled transactions) on a specified date. The differences between the original posted amounts and the revalued amounts will cause an unrealized gain or loss for each open transaction. The Accounts payable and Accounts receivable subledgers are then updated to reflect the unrealized gain or loss, and an accounting entry is posted to General ledger. If these process are run all the open transactions in the selected currencies will be revaluated for the legal entity where the process is run.

Paths:

-

Accounts payable > Periodic tasks > Foreign currency revaluation

-

Accounts receivable > Periodic tasks > Foreign currency revaluation

Foreign currency revaluation for main accounts (for general ledger).

The General ledger foreign currency revaluation can be used to revalue the balance sheet and profit and loss accounts, but only for the main accounts configured to be included in the process, the balances in foreign currencies will be revalued using the default or selected by main account exchange rate type. This process can be run for one of multiple legal entities at the same time.

Path: General ledger > Currencies > Foreign currency revaluation.

Foreign currency revaluation for bank accounts

At the end of the month, the accounting conventions require that bank account balances in foreign currencies be revalued. The periodic process for banks can revalue the selected bank accounts for the selected legal entities.

Path: Cash and bank management > Periodic tasks > Foreign currency revaluation

For both general ledger and banks revaluation process, the balance in each ledger/bank account that is posted in a foreign currency will be revalued. The unrealized gain or loss transactions that are created during the revaluation process are system-generated. Two transactions might be created, one for the accounting currency and one for the reporting currency, if a reporting currency is relevant. Each accounting entry will be posted to the unrealized gain or loss and the main account that is being revalued.

All the four periodic processes includes two parts, the simulation to review the results and the posting to the accounts defined for this purpose. The preview in General ledger is different from the simulation in the AR and AP foreign currency revaluation.

-

The simulation in AR and AP is a report and once the results are validates the process needs to be run again for final posting.

-

For general ledger and banks, the simulation is generated in a preview form in which the result can be posted, without having to run the revaluation process again. The results of the preview can be exported to Microsoft Excel to retain the history of how the amounts were calculated.

The accounts where the realized/unrealized gain or loss amounts are posted can be defined at two levels:

-

At global level, that means the same accounts for all the currencies and processes. These are defined at the Ledger page (General ledger > Ledger setup > Ledger).

-

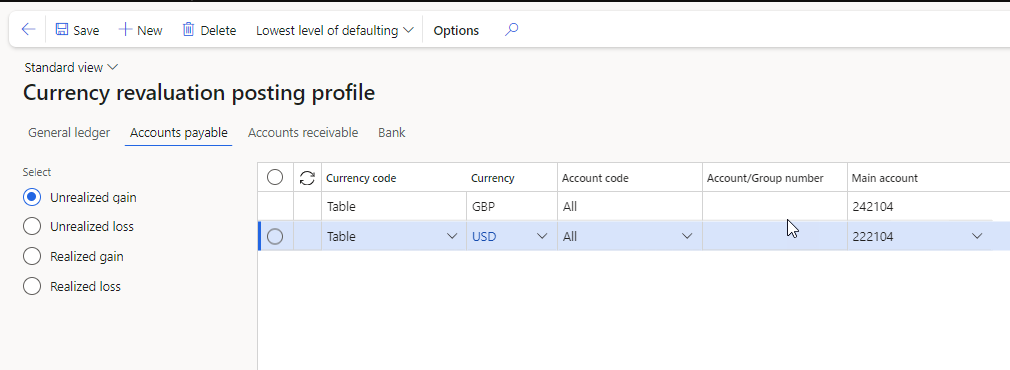

To a granular level: per currency and per module (General ledger, Accounts payable, Accounts receivable, and Bank). This allows to define the accounts across the module or for specific groups (main account category, vendor group, customer group, bank group) or specific accounts (ledger account, vendor, customer, and bank). by using the Currency revaluation posting profiles (General ledger > Currencies > Currency revaluation posting profile).

Once the process is run it can be reversed if errors occur. A new foreign currency revaluation historical record will be created to maintain the historical audit trail of when the revaluation occurred or was reversed.

As you can see, this is great and super useful functionality included in the standard system, so don't miss to use it and obtain all the benefits.

If you want to learn more or would like to know all the details don't hesitate to contact us; we are always welcome to help our readers.